Martha Jemimah Rafferty O'Rourke

Friday, May 16, 2014 at 11:58AM

Friday, May 16, 2014 at 11:58AM This lady was one of my great-grandmothers. I am told by my cousin Judith that the hairstyle, clothing and accoutrements suggest that the photograph was taken in about 1905.

She seems to have been born in 1856. She claimed to have been born in Dublin, but I doubt it. Official registration of births began only in 1866. Nearly every child was baptised, though, and fairly full baptism records survive for 19th century Dublin. She is absent from those, as is her older sister, Mary Anne Josephine.

On her marriage certificate in August 1877, she is described merely as "full age".

This was not unusual. It means that she was 21 or older, and implies that she was born before August 1856.

On April 1 1901, she signed the household census forms declaring that she was born in Dublin and was aged 44, which is consistent with her marriage certificate, and implies a date of birth between April and July 1856. (Ten years later, at the 1911 Census, she declared that she was 52 ! This understatement of age was not uncommon, especially among females.)

Her father was James Rafferty. On the marriage certificate, his occupation is given as "commercial clerk", the same as that of the groom. This suggests that he may also, like the groom, have been an accountant. I have so far been unable to find anything whatsoever about him. The surname originates in Louth/South Armagh, but there were a few in Dublin by 1850.

Her mother was also Martha (I have no clue yet as to her mother's maiden name; she is of course also an ancestor, so I want to know it.) Martha (senior) seems to have lived (per Thom's Directory) at 34 Richmond Place (North) Dublin for a few years until 1877. In 1876, one F P O'Rourke became a lodger. There had been a previous lodger by the name of Tobin. (Most households in that era had lodgers). Was Martha junior still living there then ? I have no evidence confirming it, but one would have to suspect so.

Richmond Place is an address which no longer exists in the location. It is that part of North Circular Road from St Margaret's Avenue to Summerhill, just before it becomes Portland Row.

We can only speculate why FPO'R, then only 24, took lodgings on the north-eastern side of the city when his parents and sisters were living in Harolds Cross, on the south-western side, but several likely explanations are obvious.

Anyway, Mary Anne Rafferty married Horace W. Snow in January 1876 at Dublin's (RC) Pro-Cathedral. Snow was a Londoner, and I think that the poor man got a "3-fer": not just Mary Anne, but, possibly after an interval of about a year, her mother and sister, went back to London with him.

How Snow got involved with Ms Rafferty is an interesting question, but to answer it, I have as yet no clue. Did FPO'R & HWS meet first, perhaps as accountancy trainees in London ? Or perhaps Snow, like FPO'R, was involved in political activities. Maybe one or both Rafferty sisters were employed at the Palace of Westminster.

In any event, from some time in 1876 (per Thom's Directory) FPOR seems to have used Richmond Place as a combined home & office, and in August 1877 re-installed Martha Jemimah, having married her in London (St Mary's Chapel, Pancras), with Horace Snow as his best man. As you can see, the marriage certificate says that the bride was living at 17 Lady Margaret Road, Kentish Town, which is in the same general area as all of the addresses that the Snows had in the 1880s and 1890s. (Unfortunately, the information on addresses was not available in 1877).

Her first two children, Anne and Horace, were born at Richmond Place. Frank, Alphonsus and Aubrey were born at St Mary's Villas, Drumcondra Road. Catherine and Eileen were born at 34 43 Lower Drumcondra Road. I haven't yet established whether the latter two addresses were in fact the same house. [UPDATE: I have so established.} The family later moved to Clontarf.

Then comes the death/disappearance of my great-grandfather. He is reported in "Freemans Journal" as chairing a political meeting in October 1890, and several times earlier that year in similar activities as well. The Parnell Split occurs in the following month. FPOR is never mentioned in the press again until Martha dies, 35 years later - with the exception of a notice in the London Gazette placed by Horace Snow in May 1892. The notice recorded HWS's application to administer the estate on behalf of Martha, with FPO'R stated to have died at New York on 19 January 1892. I cannot verify either date or place of death.

Whatever happened, Martha had to live the rest of her life as a widowed mother of seven.

It must have been very hard, but you couldn't say that the results were unimpressive: two architects, an accountant, and a quantity surveyor is what the boys became. Anne married Coughlan Briscoe, a very interesting character, about whom I hope to educate you in due course. I know less about Patrick Sherlock, whom Eileen married, but the National Gallery received a bequest from him, which is suggestive of substance.

I know nothing of what happened to Catherine, the second-youngest child, except that she died in childhood, and before 1901.

Martha died in March 1927. All but one of her ten grandchildren had been born by then. I will not identify them here, but they included my father and his two brothers, a Briscoe, and women who married into the Barden, Tonge, Moore, Cleary and Royston families.

I think that Martha is the old lady pictured here not long before her death with my father and others.

Prior to her death, Eileen, still single, lived with her (I suspect strongly that she is the young-ish woman - not the girl - beside Martha in the above photograph). She probably got to keep all of her mother's stuff, such as it may have been. In any event, I can trace no application for probate or to administer her estate. There's nothing sinister about that.

Unfortunately, even though she was my father's godmother, Eileen's fate is unknown. She married in 1930, was widowed in 1940, and the last reference to her gives an address in London.

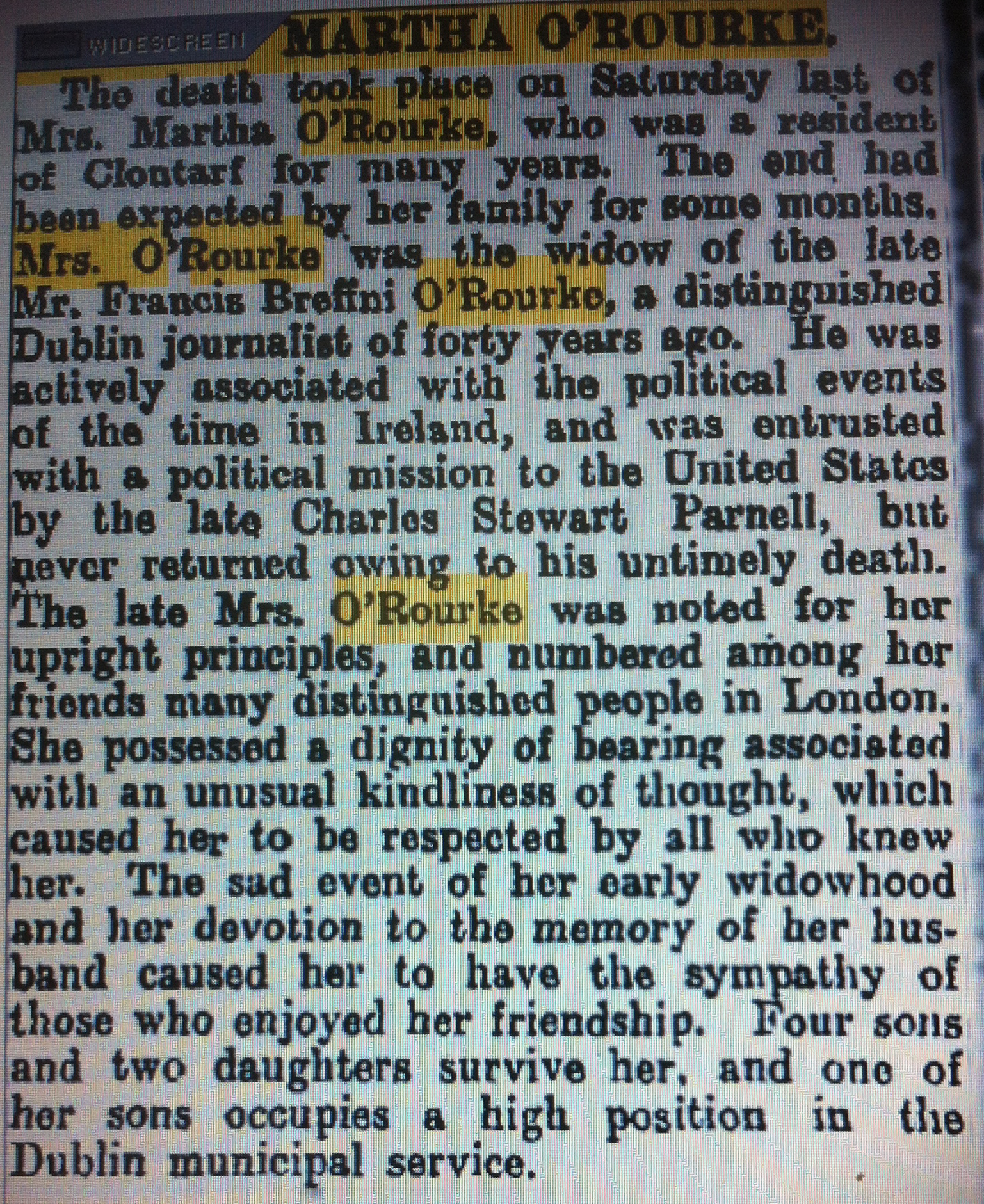

"The Irish Times" obituary for MJRO'R is here.

It is remarkable for its lack of any reference to her origins, or to her surviving sister, Mary Anne Snow.The statements about the circumstances of my great-grandfather's demise are not implausible but neither I nor anyone else has yet been able to verify them.

Fergus O'Rourke

Fergus O'Rourke